Solar Energy

What About Solar Panels?

Solar Energy

What About Solar Panels?

- The sun always radiates heat and light during the day. We can utilize this energy in different ways.

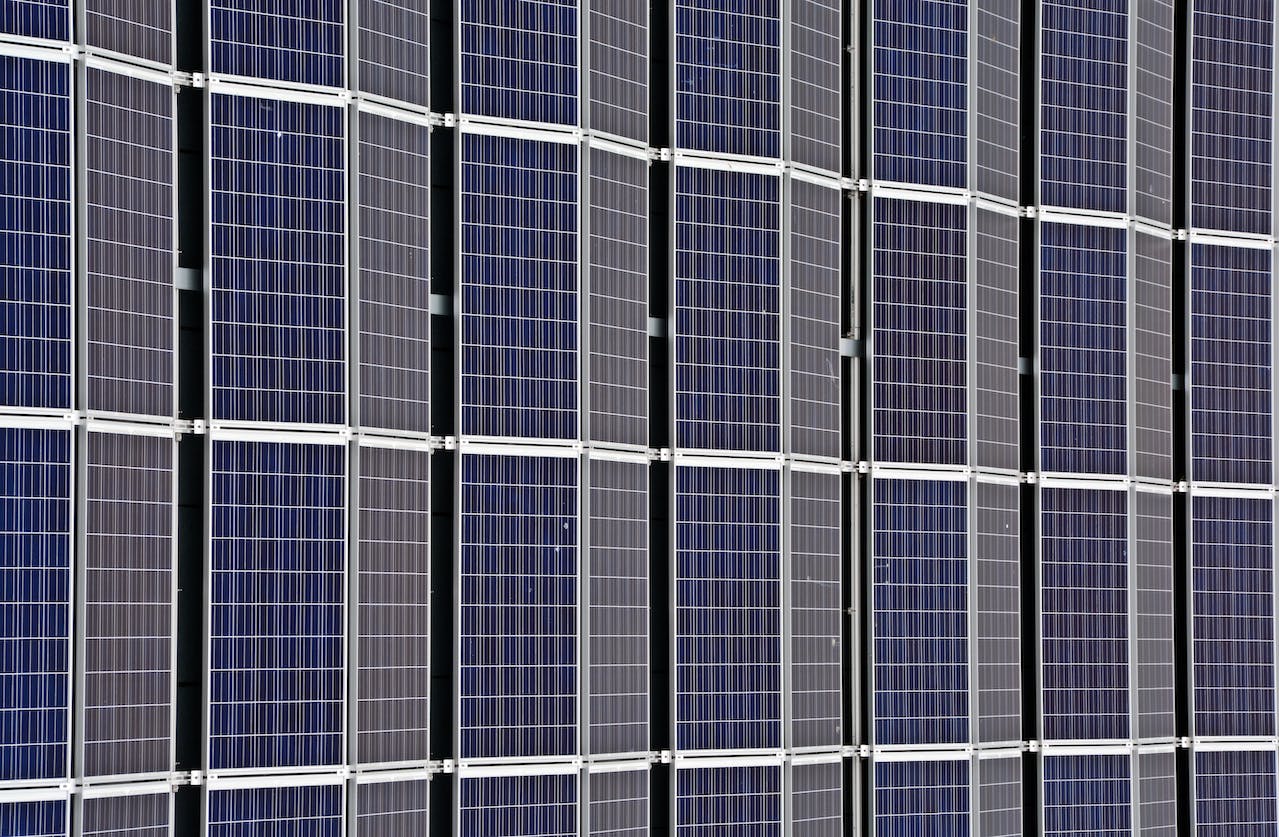

- Photovoltaic cells can convert sunlight into electricity. A group of photovoltaic cells are known as solar panels.

- Homeowners can have solar panels installed on their houses and buy less electricity from their utility companies.

Solar Equipment

that you can install

Solar PV (photo-voltaic)

systems

cost about $3 per watt

installed. The exact cost depends on how much solar power you can collect and

how

much electricity you use, so it cost will vary from home to home.

Therefore, installing a 7,000-watt (7-kilowatt) system costs approximately $21,000.

Depending on the climate, such a

system would provide 20 to 35 kilowatt-hours of electricity per days

and could meet most household demands.

Solar hot water systems can meet 50% of the hot water needs for a family of four and generally cost between $5,000 and $7,000 to install.

Net metering:

Most states have established “net metering” rules for customers who generate excess electricity through solar, wind, or other systems and feed it into the grid. In net metering, a bi-directional meter records the electricity the home draws from the grid and the excess electricity the homeowner’s system feeds back into the grid. A ground-mounted solar system, solar water heater, and solar roof tile qualify for the federal tax credit.

Solar Tax Credit:

The amount of the credit you can take is a percentage of the total improvement expenses

in

the year of installation:

- 2022 to 2032: 30%, no annual maximum or lifetime limit

- 2033: 26%, no annual maximum or lifetime limit

- 2034: 22%, no annual maximum or lifetime limit

The tax credit will expire after 2034.

Total improvement expenses include = the cost of solar panels + wires +converters+ labor + any related taxes + permits cost + battery system + inverters.

E.x: If the cost of purchasing and installing the solar system is $30,000 while the tax credit is at 30%, you get a tax credit of $9,000 that you can deduct from your federal tax. Suppose your federal tax per year is $3,000.

You can deduct and pay with a tax credit for three years. You can apply for a tax credit until you use $9,000.

To get this tax credit, you must file the tax credit form , IRS FORM 5695, with your tax returns each year.