Key Programs and Incentives

Benefits For You

Key Programs and Incentives

Benefits For You

Green Power Partnership

This voluntary program encourages organizations, including homeowners, to purchase

green power. Remember, there is no cost to join the Green Power Partnership!

Green power is electricity generated from renewable sources like

solar, wind, and

geothermal.

Here are some of the benefits of joining the Green Power Partnership:

- Using green power reduces greenhouse gas emissions and other air pollutants

- Green power helps combat climate change by reducing the use of fossil fuels

- Green power helps in improving air quality and public health

- Joining the Green Power Partnership shows that you are committed to

environmental

responsibility

Consumption

Tax

Credits:

Another Incentive!

These credits are awarded directly to consumers who purchase green power, reducing their

tax

liability.

Credit amount: The amount of credit varies significantly from state to state. Some

states

offer a fixed credit per kWh of green power purchased, while others provide a

percentage-based

credit.

Eligibility: Eligibility

requirements also

vary.

Some

states offer credits to any consumer who

purchases green power, while others have specific requirements, such as the type of

renewable

energy source or the size of the energy system.

Claiming the credit: The process

for

claiming

the

credit also differs. You may need to submit a

separate form with your tax return or apply for the credit through a specific program.

Combined Heat and Power Partnership:

CoGeneration!

Combined Heat and Power

(CHP),

or cogeneration, is an efficient technology that utilizes a single

fuel source to generate electricity and heat.

Benefits of CHP Systems:

- CHP systems convert up to 90% of the fuel's energy into usable energy, significantly

reducing energy waste compared to conventional power plants

- They generate both electricity and heat on-site, resulting in lower energy costs

- CHP systems produce fewer greenhouse gas emissions when compared to fossil fuels

- On-site generation can provide backup power during outages

- CHP systems create more jobs in manufacturing, installation, and maintenance

Available CHP Systems for Homeowners:

Micro-CHP Systems: These smaller, more affordable systems are

specifically designed for

residential use. Typically fueled by natural gas, they can generate up to 5 kW of

electricity

and provide heating and hot water. Micro-CHP systems usually cost between $15,000 and

$25,000

to install, including equipment and labor.

Packaged CHP Systems: These pre-configured systems offer a

convenient and streamlined

installation process but may be less customizable. These systems can cost upwards of $30,000

to install.

Maintenance Requirements: Regular maintenance, which ranges

from $500 to $1,000 per year,

is necessary to ensure optimal performance and efficiency.

Availability and Pricing: Fuel Type

Natural gas: the most common and

typically cheapest fuel

source, but prices fluctuate depending on location and supply.

Propane: a more expensive

alternative

than natural gas,

but

more readily available in some areas.

Biogas: renewable fuel

source that

can be produced from

organic waste but may require specific infrastructure and processing.

Environmental Regulations:

Compliance with local

environmental regulations is required for CHP installation and operation.

- A homeowner with a 5 kW micro-CHP system using natural gas and saving 25% on their

energy

bills

might see an annual payback period of around 7-10 years.

- A homeowner with a larger 10 kW system and higher energy consumption might see a

faster

payback

period of around 5-7 years.

Availability and Pricing: Fuel Type

Natural gas: the most common and typically cheapest fuel source, but prices fluctuate depending on location and supply.

Propane: a more expensive alternative than natural gas, but more readily available in some areas.

Biogas: renewable fuel source that can be produced from organic waste but may require specific infrastructure and processing.

Environmental Regulations: Compliance with local environmental regulations is required for CHP installation and operation.

- A homeowner with a 5 kW micro-CHP system using natural gas and saving 25% on their energy bills might see an annual payback period of around 7-10 years.

- A homeowner with a larger 10 kW system and higher energy consumption might see a faster payback period of around 5-7 years.

Residential Clean Energy

Credit:

The amount of the credit you can take is a percentage of the total improvement

expenses in

the

year of installation:

- 2022 - 2032: 30%, no annual

maximum or lifetime limit

- 2033: 26%, no annual

maximum or lifetime limit

- 2034: 22%, no annual

maximum or lifetime limit

The credit is nonrefundable, so the credit amount you receive can not exceed the

amount you

owe in

tax.

You can carry forward any excess unused credit and apply it to reduce the

tax you

owe

in future years.

The credit has no annual or lifetime dollar limit except for credit limits for fuel

cell

property.

Fuel cell property: The credit amount for fuel cell property is

limited to $500 for

each

half

kilowatt of capacity of the property.

If more than one person lives in that house, the combined credit for all residents

can not

exceed

1,667$ for each kilowatt of fuel cell capacity.

Eligibility: You

can claim this credit for any new or existing home in the United States.

You can only claim this credit if the house is not rented or is your residence.

You must live at least part-time.

You can only claim this credit if the house is not rented or is your residence.

You must live at least part-time.

Qualified Expenses:

1. Solar electric panels

2. Solar water heaters - must be qualified by a solar rating certification

corporation or a

comparable entity endorsed by your state.

3. Wind turbines

4. Geothermal heat pumps - must meet Energy Star requirements.

5. Fuel cells

6. Battery storage technology (beginning in 2023)-must have a capacity of at least 3

kilowatt

hours.

7. Qualified expenses include labor costs for onsite preparation, assembly, or

original

property installation and piping or wiring to connect it to the home.

You may need to subtract rebates or other financial

incentives

from your qualified property expenses when calculating your credit.

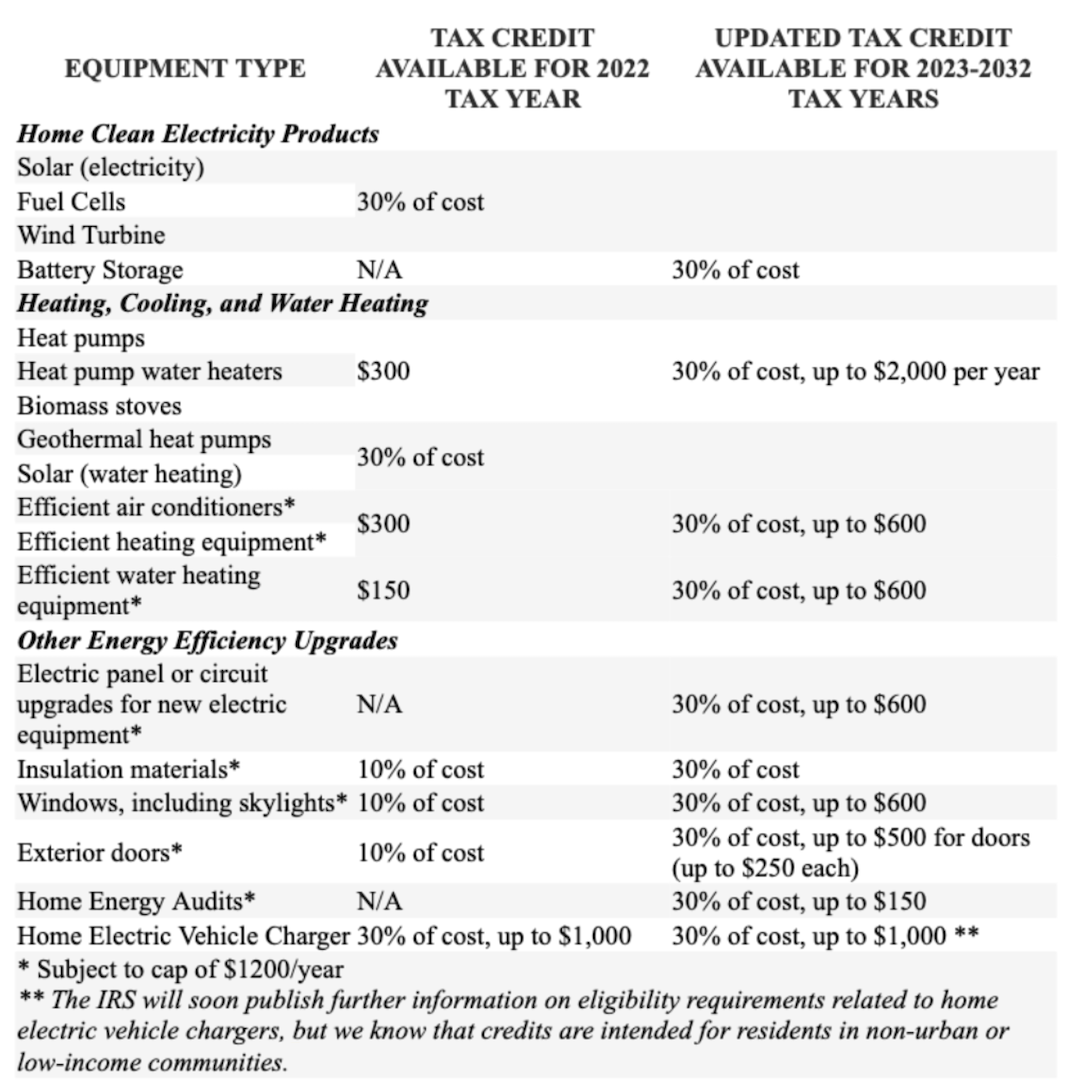

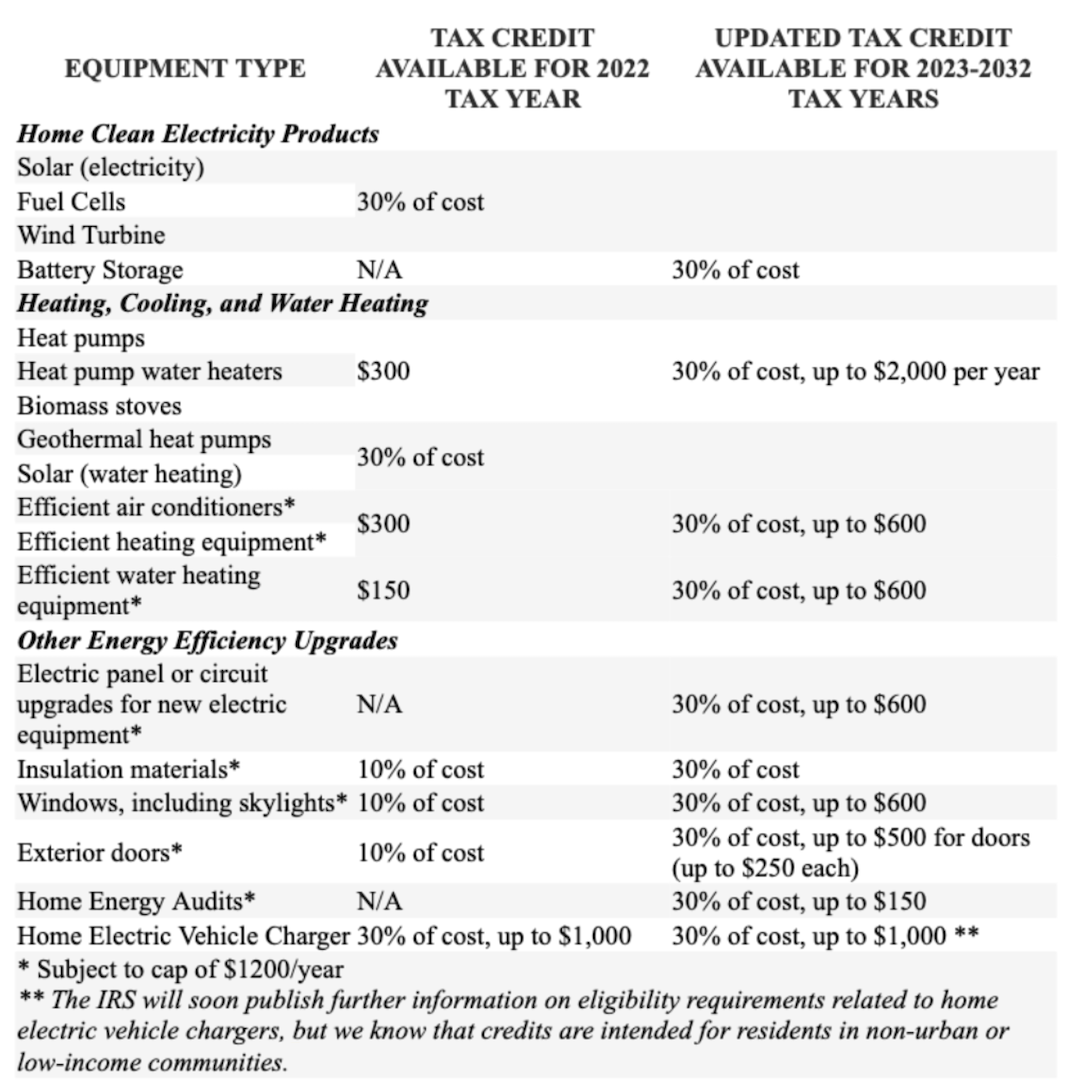

Energy Efficient Home Improvement Credit

These expenses may qualify with some requirements:

- Exterior doors, windows, skylights, and insulation materials

- Central air conditioners, water heaters, furnaces, boilers, and heat pumps

- Biomass stoves and boilers

- Home energy audits

The amount of the credit you can take is a percentage of the total

improvement

expenses in

the

year of installation:

- 2022: 30%, up to a lifetime maximum of $500

- 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves, and

boilers

have

a separate annual credit limit of $2,000), with a lifetime limit.

Eligibility for this is the same as residential clean

energy credit.

The Inflation Reduction Act of 2022

provides funding, incentives, and programs to speed up the transition to a clean energy economy.

Rooftop Solar

The Inflation Reduction Act will help more Americans harness the sun's energy to power their

homes with clean energy and save big on utility bills. FederalTax credits are available to cover

up to 30% of the installation costs which can be paired with additional state-specific

incentives. The average family will save 300$ per year or 9000$ over the system's lifetime.

Insulation and Air Sealing

The Inflation Reduction Act provides tax credits and rebates for a range of home improvements

that reduce energy leakages like insulation material, which can lower heating and cooling costs

by up to 20% or save money on utility bills.

Clothes Dryer

The Inflation Reduction Act provides rebates that can cover up to 100% of the costs of

purchasing and installing a new electric heat pump dryer as they are more efficient than

conventional electric dryers and gas dryers in saving money on the electric bill with each load.

Electric Stove or Oven

The Inflation Reduction Act provides rebates that can cover up to 100% of the cost of electric

stoves, cooktops, ranges, and ovens depending on household eligibility as they are more energy

efficient than gas stoves helping families save money and keep unhealthy pollution out of their

homes.

Weatherized Windows and Doors

Windows can be responsible for 25-30% of heating and cooling energy use, and doors can leak

significant amounts of energy as well. The Inflation Reduction Act supports the upgrades of

these exterior windows and doors along with home energy audits.

Electric Vehicle

The Inflation Reduction Act gives tax credits of up to 7000$ for new electric vehicles and 4000$

for used electric vehicles saving families an average 950$ a year on fuel costs.

Heat Pump Water Heater

The Inflation Reduction Act includes tax credits and rebates that can cover up to 100% cost,

depending on household eligibility for installing a heat pump water heater that is two to three

times more energy efficient than conventional water heaters.

Want to learn about your specific state?

Check out

the

website DSIRE!

For more information go to whitehouse.gov!

Summary of Incentives